The United Arab Emirates is witnessing a remarkable transformation in its pet care industry, with pet sitting emerging as one of its fastest-growing segments. Fueled by changing lifestyles and growing pet ownership, this market presents significant opportunities for investors and service providers alike. Let’s explore the comprehensive landscape of this dynamic sector.

Expanding Pet Sitting Market Size in the UAE

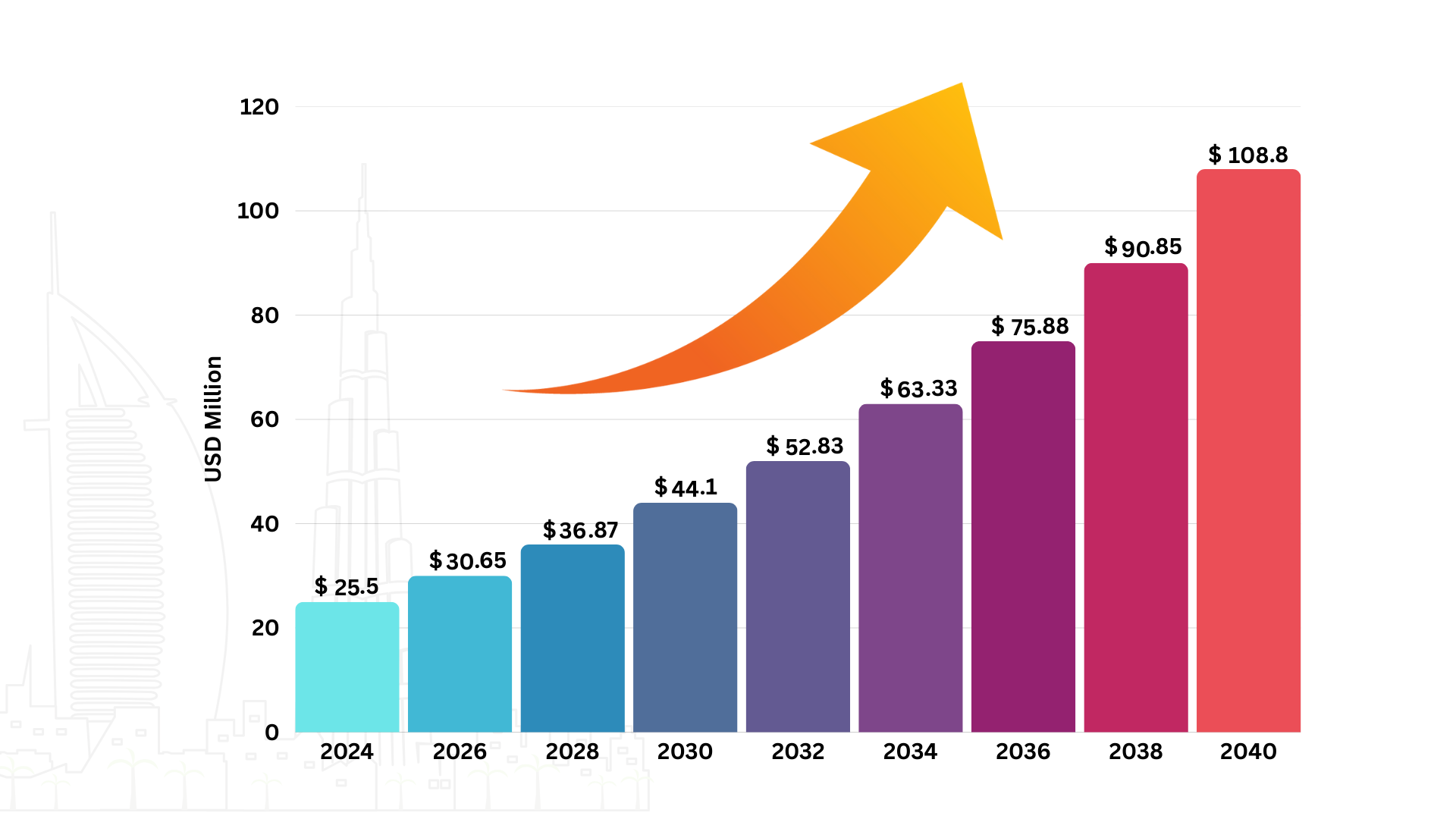

The UAE pet sitting market has demonstrated exceptional growth, reaching USD 25.5 million in 2024. With a robust compound annual growth rate (CAGR) of 14.7%, the market is projected to surge to USD 44.1 million by 2030 and continue expanding significantly to approximately $108.8 million by 2040. This rapid growth highlights the rising demand for trusted, professional pet sitting services across the UAE. This growth substantially outpaces the broader pet care industry, underscoring the growing preference for professional pet-sitting services.

- 2024 Revenue: $25.5 million

- 2030 Revenue: $44.1 million

- 2034 Revenue: $63.3 million

- 2040 Revenue: $108.8 million

- Growth Rate: 8.6% CAGR

- Largest Segment: Dogs

- Fastest Growing Segment: Cats

Within the larger pet care ecosystem, which includes veterinary services, grooming, and pet food, the sitting segment stands out as the fastest-growing category. The overall pet industry is expected to reach USD 2 billion by 2025, indicating substantial growth potential across all pet-related services.

Key Growth Drivers Analysis

Demographic Shifts

The UAE’s unique population composition plays a crucial role in market expansion. With expats constituting over 80% of the population and frequent business travel being commonplace, there’s consistent demand for reliable pet care services. This is complemented by a 30% surge in pet ownership since the pandemic, creating an expanded customer base.

Cultural Evolution

The trend of “pet humanization” has transformed how residents view their companion animals. Pets are increasingly considered family members, leading owners to seek premium care services that ensure their pets’ emotional and physical well-being. This shift has elevated service expectations and willingness to pay for quality care.

Urban Lifestyle Demands

The fast-paced urban environments of major cities create a natural demand for professional pet services. Long working hours, frequent social commitments, and business travel patterns have made professional pet care essential rather than optional for many urban residents.

UAE Pet Sitting Market Segmentation by Service Type

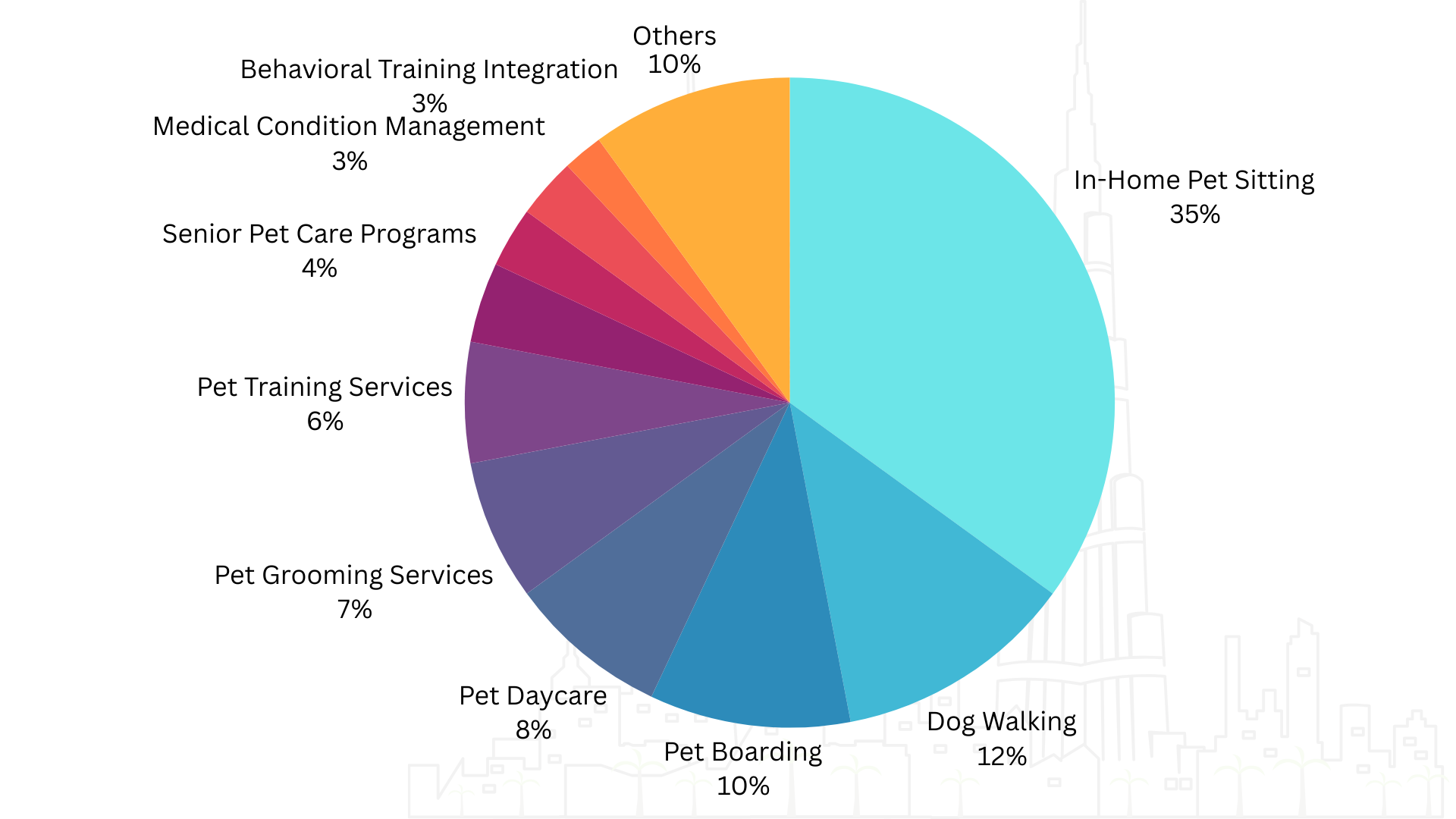

This data shows how demand is distributed across various pet services in the UAE, with a clear focus on in-home care.

Dominance of In-Home Care: In-Home Pet Sitting is the largest segment by a significant margin, capturing 35% of the total market value. This highlights the strong owner preference for their pets to remain in a familiar environment.

Top 3 Services: In-Home Pet Sitting (35%), Dog Walking (12%), and Pet Boarding (10%) collectively account for 57% of the entire market.

Strong Demand for Daily Services: Dog Walking and Pet Daycare (8%) represent substantial demand for services catering to busy, daily schedules.

Specialized Care Growth: While smaller, specialized services like Senior Pet Care Programs (4%), Medical Condition Management (3%), and Behavioral Training Integration (3%) indicate a maturing market and a willingness to pay for customized, high-value care.

Market Segmentation: The dog sitting segment currently dominates with 71.76% market share, while cat sitting services are experiencing the fastest growth rate. This reflects changing pet ownership patterns and the unique care requirements of different animal types.

Pet Type Distribution in the UAE

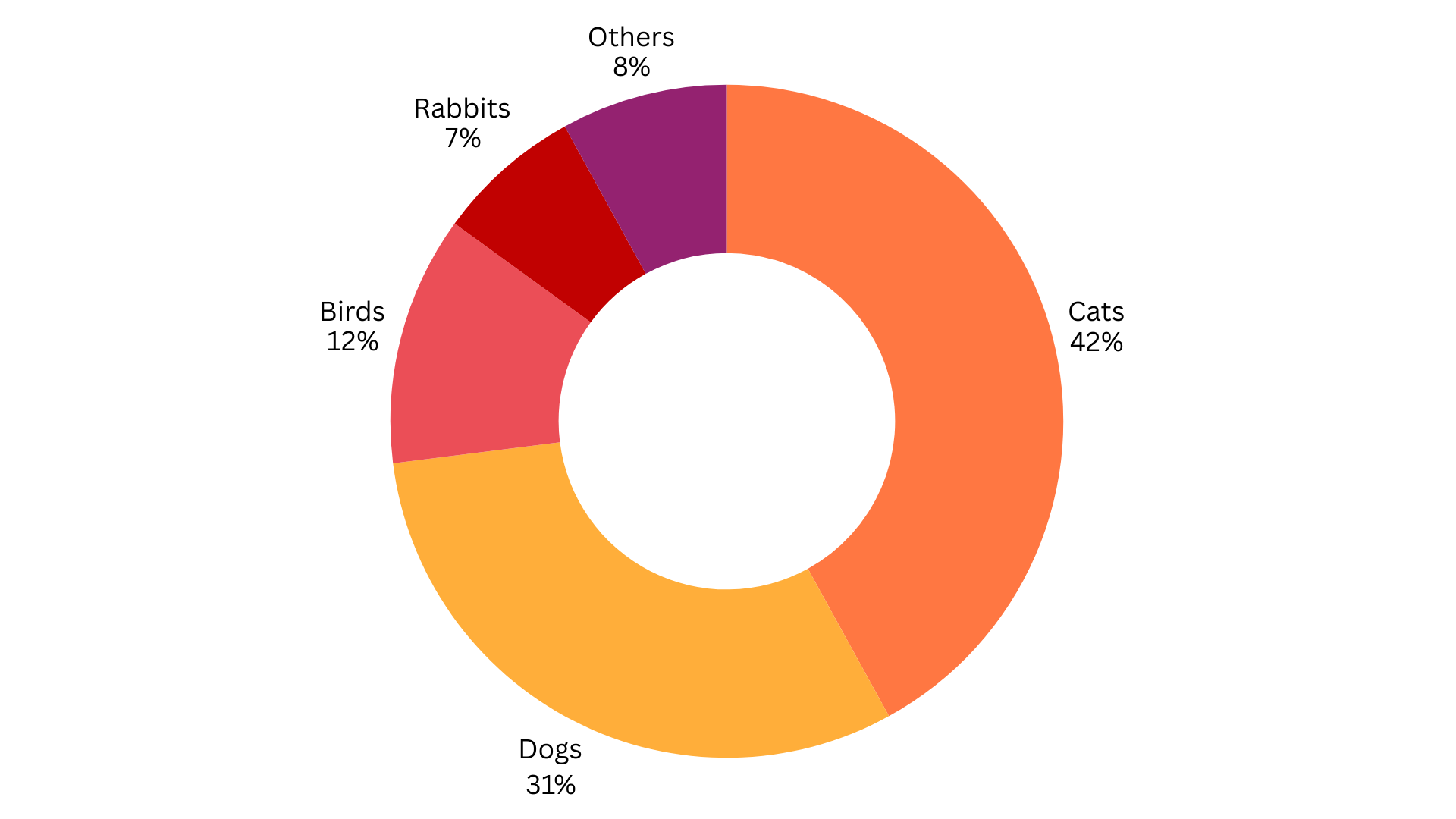

This data clearly illustrates that the majority of the pet market in the UAE is dominated by Cats and Dogs.

- Cats: Cats hold the largest share of the market at 42%. This indicates that cat ownership is the most common preference among pet owners in the UAE.

- Dogs: Dogs represent the second-largest segment, accounting for 31% of the market. Combined, cats and dogs make up a significant 73% of the total pet market.

- Birds: Birds form a considerable segment, with a market share of 12%.

- Rabbits: Rabbits account for a smaller proportion of the market at 7%.

- Others: The remaining 8% is comprised of other small or niche pet types.

Regional Market Analysis

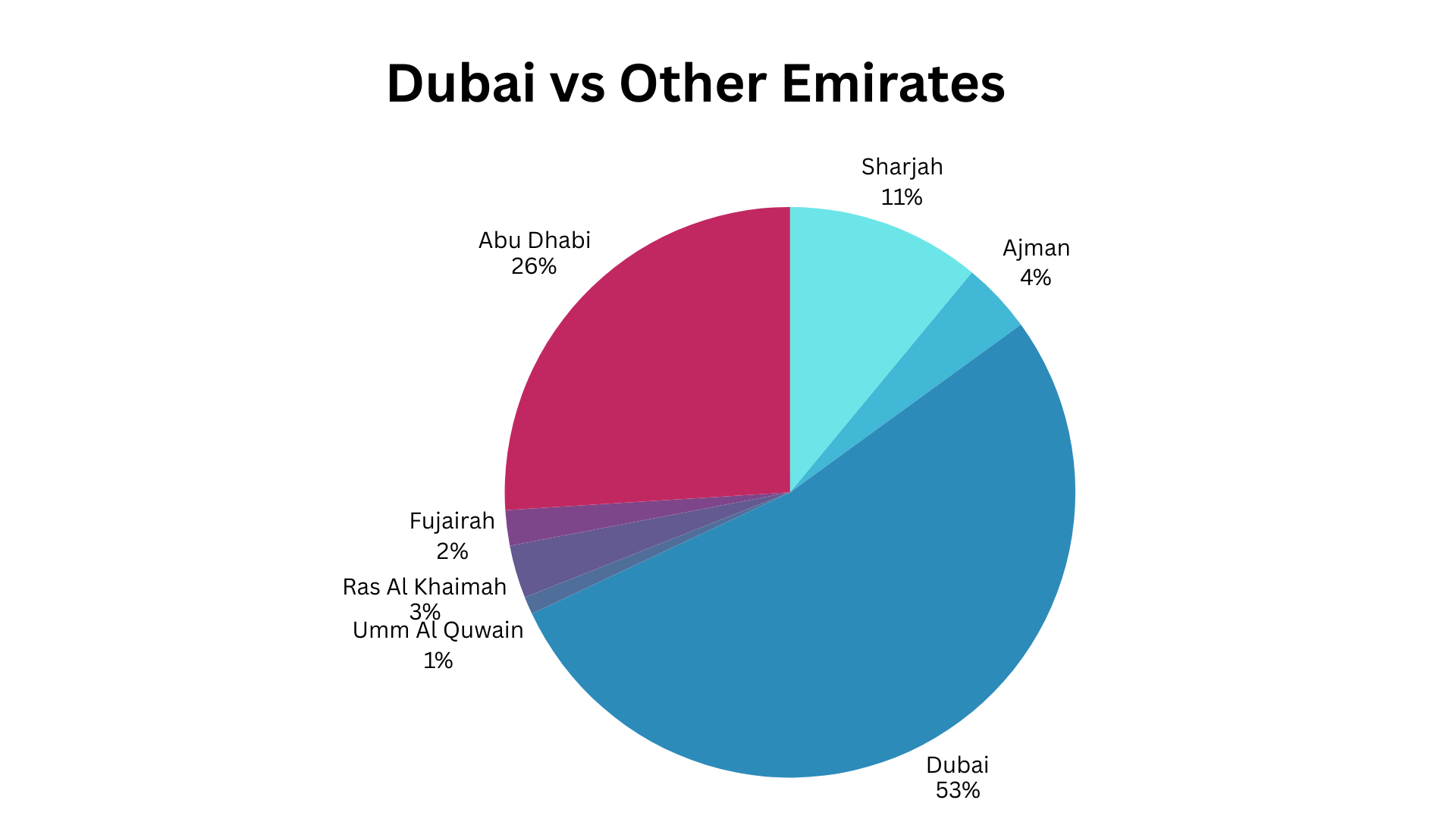

Dubai and Abu Dhabi: These emirates lead the market due to their high concentration of expatriates, advanced pet infrastructure, and premium service demand. The presence of pet-friendly communities, dedicated parks, and supportive regulations has created an ideal environment for pet sitting services to thrive.

This data clearly shows that Dubai and Abu Dhabi jointly dominate the vast majority of the market.

Dubai’s Dominance: Dubai holds the highest share, commanding 53% of the market, solidifying its position as the primary market leader.

Major Market Concentration: Dubai (53%) and Abu Dhabi (26%) together constitute a massive 79% of the total market share.

Significant Second Tier: Abu Dhabi is the crucial second-largest market segment at 26%.

High-Growth Region: Sharjah holds a substantial share (11%) and represents the third-largest demand area, often noted for having high growth potential.

Smaller, Niche Markets: Ajman (4%), Ras Al Khaimah (3%), Fujairah (2%), and Umm Al Quwain (1%) represent smaller, more localized markets.

Northern Emirates Emerging Opportunities

- Sharjah: Showing strong growth in family-oriented pet care services

- Ras Al Khaimah: Developing adventure and tourism-focused pet sitting

- Ajman and Umm Al Quwain: Emerging as affordable care markets

- Fujairah: Creating niche coastal pet service opportunities

Investment Opportunities in the UAE

The UAE’s pet sitting market is entering a high-growth phase driven by rising pet ownership, busy professional lifestyles, and a shift toward personalised, cage-free in-home care. With consistent double-digit growth and increasing spending ranges in Dubai and Abu Dhabi, this sector is now one of the strongest emerging service industries for investors.

Market Size & Growth Potential

- UAE Pet Sitting Market (2024): USD 25.5 million

- Projected by 2030: USD 44.1 million

- Growth Rate (CAGR 2025 – 2030): 14.7%

- Broader UAE Pet Care Market: Estimated between USD 24M – 200M+, depending on category segmentation (grooming, training, boarding, supply retail).

Industry Ambition: UAE aiming for a pet care ecosystem worth nearly USD 2 billion by 2025 (combined products + services).

Primary Service Categories

- In-Home Pet Sitting (Care Visits & Drop-In Visits): Short, scheduled visits to your home where a sitter provides feeding, fresh water, litter cleaning, playtime, dog walks, and welfare checks. Ideal for pets who are comfortable alone for several hours at a time. Suitable for cats, dogs, puppies, and senior pets needing short-duration care.

- Overnight Pet Sitting (In-Home Overnight Care): A sitter stays overnight at your home (e.g., 8-12 hours) to provide evening and morning care, companionship, feeding, walking, and medication. The sitter may leave for work or errands during the day, but your pet enjoys comfort and routine in their familiar environment. Suitable for dogs, anxious pets, senior pets, and multi-pet households

- Live-In Pet Sitting (24-Hour Stay Care): A sitter lives in your home full-time while you’re away, providing near-constant care and companionship. This ensures your pet’s routine is maintained with feeding, walking, and supervision, with only brief absences. Ideal for high-anxiety pets, special-needs pets, multi-pet homes, and long travel periods.

- Pet Boarding (In-Home): Your pet stays in the sitter’s home, receiving a family-style environment, playtime, feeding, daily walks, and constant supervision. Suitable for social pets and dogs who adapt well to new environments.

Financial Snapshot & Unit Economics

Average Pricing in the UAE

- Standard 30-min Visit: AED 60 – 120

- 60-min Visit: AED 120 – 200

- Overnight Stay: AED 200 – 450

Monthly Packages: AED 480 – 1,000+

Unit Economics

- Sitter payout: 40 – 60% of revenue (marketplace model)

- Gross margin for platform: 30 – 60%

- Customer lifetime value (LTV): High due to repeat usage and long-term subscriptions

- Demand peak seasons: Eid, summer holidays, Christmas, and New Year

This structure makes pet sitting one of the most predictable, low-capex, high-margin segments in the UAE’s pet industry.

Regulatory Framework and Compliance

Business Licensing: Operating a pet sitting business requires a commercial license from the Department of Economic Development (DED), typically classified under “Pet Care Services.” Both individual entrepreneurs and established companies must comply with these licensing requirements.

Operational Standards: Dubai Municipality and other local authorities have established clear guidelines for animal welfare, including:

- Humane treatment standards

- Sanitation and hygiene requirements

- Adequate provision of food, water, and shelter

- Emergency preparedness protocols

Risk Management: Professional liability insurance is becoming standard practice, protecting against potential accidents or injuries. Comprehensive service contracts outlining responsibilities, emergency procedures, and liability terms are essential for building client trust and managing business risks.

Market Leadership & Strategic Dominance

1. Pawland

Pawland is the award-winning, most trusted, and highest-reviewed No. 1 pet sitting company in the UAE. Known for its top-rated, cage-free, and highly personalized in-home care, Pawland has become the first choice for pet owners across Dubai, Sharjah, and all Emirates

Services: Pet sitting, In-home Pet boarding, Dog walking, Bird Sitting & Boarding, overnight stays, senior pet support, medication administration, and real-time photo/video updates.

Ratings: 4.9/5 with 350+ pet owner reviews

Coverage: Dubai, Abu Dhabi, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah, and Fujairah

Why Pawland Stands Out: Highly experienced and trained sitters, 1-on-1 care, emergency support, flexible bookings, and the highest customer satisfaction rate in the UAE.

2. Homely Petz

Homely Petz has been providing reliable pet care in the UAE for over ten years, trusted by families and pet owners.

Services: Pet sitting, dog walking, pet training (behavioral & obedience), pet taxi, home checks, grooming add-ons, and special needs care.

Ratings: 4.7/5

3. Petami

Petami is an app that connects pet owners with sitters, making it easy to arrange pet care quickly and conveniently. It is especially popular among busy professionals and people who travel often, offering flexible options for daily visits, dog walking, and overnight care.

Services: In-home sitting, dog walking, cat sitting, pet boarding, daycare, grooming add-ons, and pet photography.

Ratings: 4.8/5

4. UrPetBabysitter

UrPetBabysitter provides calm, stress-free, and caring in-home pet care. It is ideal for cats and pets that are sensitive to new environments, offering personalized attention to make each visit comfortable and safe.

Services: Cat sitting, dog sitting, overnight stays, puppy visits, litter cleaning, feeding, medication support, and specialized care for anxious or senior pets.

Ratings: 4.8/5

5. Happy Tails

Happy Tails offers reliable and budget-friendly pet care for families. They provide daily visits, dog walking, and long visits, focusing on keeping pets comfortable and cared for while their owners are busy or away.

Services: Daily pet visits, dog walking, cat sitting, small pet care, long-term vacation pet sitting, puppy support, and medication assistance.

Ratings: 4.7/5

Future Outlook and Emerging Trends

Technology Integration: The adoption of digital platforms is revolutionizing service delivery. Features like real-time GPS tracking, automated booking systems, and video updates are becoming industry standards that enhance both customer experience and operational efficiency.

Service Specialization: The market is moving toward niche services, including:

- Senior pet care programs

- Medical condition management

- Behavioral training integration

- Breed-specific care protocols

Market Expansion: Beyond the current urban centers, secondary cities, and Northern Emirates present significant growth opportunities. The development of pet-friendly infrastructure across the UAE supports this geographic expansion.

Professionalization: The industry is evolving toward higher standards through:

- Certification programs for pet sitters

- Standardized training curricula

- Quality assurance protocols

- Enhanced background verification processes

Frequently Asked Questions

The UAE pet industry is projected to reach USD 2 billion by 2025, while the core pet care market was valued at USD 24.4 million in 2024

The pet sitting market was valued at USD 25.5 million in 2024 and is projected to reach USD 44.1 million by 2030, growing at 14.7% annually

The UAE pet care market was valued at USD 24.4 million in 2024 and is growing at 6.4% annually through 2030

Sharjah represents an emerging market focused on family-oriented, affordable care services, with rates typically 15-20% lower than Dubai

The total pet industry is projected to reach USD 2 billion by 2025, while core pet care services were valued at USD 24.4 million in 2024

While specific data varies, the retail segment shows growing demand for premium products and increased competition from online platforms.

Reliable data can be found through Dubai Municipality reports, Department of Economic Development data, and international market research firms.